PROPERTY TAX BILLS FOR 2025 HAVE BEEN MAILED.

They are due Friday, November 7th, 2025. Office will be open from 9 am to noon on Friday, November 7th, 2025.

WHEELOCK NOW ACCEPTS CREDIT/DEBIT CARD PAYMENTS FOR PROPERTY TAXES ONLINE.

THIRD PARTY FEES ARE LISTED BELOW

You can now pay your Property Taxes via MuniciPAY using:

- Visa, MasterCard, Discover, American Express (service fee will apply, see below)

- Electronic Check Payments (service fee will apply, see below)

- 3rd party fees are noted below

Delinquent Property Taxes MUST be paid through the Delinquent Tax Collector. Please do not use this platform for such payments.

Credit Card Payments Made Online

Now you can pay ONLINE from the comfort of your home or office by using our online payment service. Credit cards accepted: MasterCard, Discover, American Express or Visa. A per transaction service fee of 2.65% or $3.00 minimum will be charged by the payment processing company for this service.

Electronic Check Payments

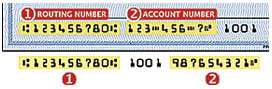

TOWN OF WHEELOCK now accepts electronic check payments using our online payment service. Payments will be charged to your checking or savings account at your bank. You will need your 9-digit routing number, as well as your account number from your personal checks (see example below). A per transaction service fee of $1.50 will be charged by the payment processing company for this service.

IMPORTANT: When Payment Options appears, click on the “Switch to Pay with Check” link and then continue entering your information.